The administrative centre One breach announced recently compromised the details off 100 mil Us citizens, that is nearly 40 % of all of the U.S. grownups. After the Equifax, Address, House Depot, and Marriott hacks, it can be an easy task to shrug off of the development of some other problem, however, that selection of users is at form of exposure throughout the Money One to infraction: 80,100 People in the us exactly who applied for secured playing cards with the providers.

This new hacker, Paige Thompson, achieved the means to access information that is personal such money, target, and you may fico scores having apparently all current individuals so you’re able to Money You to handmade cards. To own secured credit candidates, just who include reasonable-money, checking account pointers was compromised also.

I Did at the Financing That. Hacks Along these lines Are Very Risky to own Low-Income Some body

A protected card normally is much like other subprime handmade cards – it nonetheless are accountable to the financing bureaus, it however charge interest and you will late charge, and you may however default on the cards or even create your costs. However, borrowers need certainly to lay out a protection deposit under control discover that, and that means access to the new borrower’s checking account information.

Score Talk Poverty On your Email

The reality that bank account back ground was affected enhances the limits for those people: also compared to the bank card scam, solving savings account fraud is no walk in the park, together with costs here might be borne of the people who are unable to afford to just take a knock.

Having users who don’t thought they are able to become approved to have an effective regular charge card, secured notes are going to be enticing. And that are those individuals users? They do not have a fortune: Federal Set aside Financial of Philadelphia specialist Larry Santucci have learned that brand new median earnings off shielded card people was $35,one hundred thousand, versus $fifty,100 getting Us citizens having unsecured credit cards.

Obviously, once the such revenue was care about-stated, and therefore credit card companies commonly expected to validate the amount of money of the many charge card individuals, that it income information is more than likely overstated: Lots of people see they may be able rating rejected to have a credit credit if you are too terrible.

I has worked at the Capital You to definitely for 5 age, regarding 2013 so you can 2018. Getting a preliminary stretch during that time, I was responsible for the fresh secure card device. I am aware really protected credit customers are in the no position in order to ingest a monetary treat – and you will, sadly, getting your bank account study released leaves your inside a much more threatening standing than a simple infraction of your charge card count, otherwise the Societal Safeguards matter.

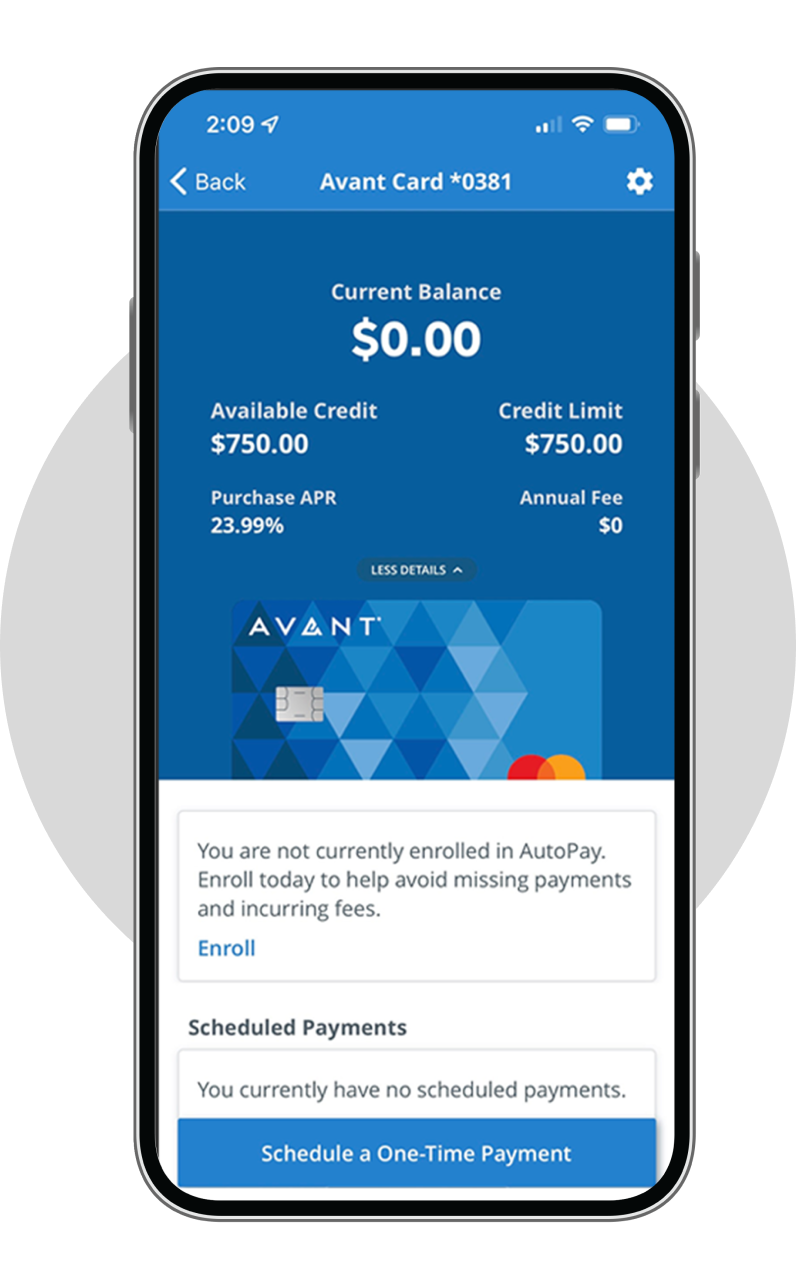

For many who apply for a capital One shielded card as well as have recognized, you can 1st feel tasked an effective $200 borrowing limit, contingent for you submitting a safety put regarding possibly $44, $99, or $2 hundred. Minimal defense deposit you should make depends on your risk because an applicant.

Think about one to for an additional: People are putting down an effective $two hundred deposit, discover a beneficial $200 borrowing limit, while the tool tends to make currency because individuals after that borrow secured on its individual put at the a percent rate of interest – among large in the business – and have hit with late charges up to $39 once they are not able to generate repayments timely. Santucci has actually discovered that one from inside the four secure cards people will pay the mastercard expenses entirely every month.

Some secured cards customers are new-to-borrowing from the bank, but biggest banking institutions such Lender away from The united states, Wells Fargo, to discover have all become proven to share with you handmade cards, at the least having small borrowing from the bank constraints, to those rather than credit score. While the fresh-to-borrowing you provides a bank checking account, while know your odds of being approved for check over here an unsecured credit card are very large for those who head into a branch of lender (obviously, not everyone finds out that it), you are not probably come across a protected cards attractive.