You really have heard of contrary mortgages, and the senior years option they may be able render to people otherwise partners who will be family rich, dollars bad.

For those seeking make use of their home collateral during the senior years, an opposite home loan are a helpful device to let this. A home collateral personal line of credit (HELOC) is another option.

There’s a lot more as achieved by getting a face-to-face mortgage in the 2021. With new service rules set up, plus long time, little-recognized benefits, an other mortgage is found given that a better alternative than simply good HELOC in some instances.

quicken loans Echo Hills Colorado

Rather than just making it possible for interest to expand into opposite financial mortgage is reduced in the event that mortgage happens owed, contrary mortgage proprietors can create repayments towards the the loan.

This allows them not just to keep the notice equilibrium down, but to love an ever-increasing line of credit you to definitely expands throughout the years.

Having a contrary Financial You may want to Generate Payments

An opposite mortgage try financing, and you will like most money, it comes down which have called for attention. In the place of extremely fund, one to attention doesn’t need to be distributed through to the mortgage arrives due-usually in the event that borrower movements on domestic or becomes deceased.

Being qualified borrowers who are 62 otherwise older is also receive payments of their home guarantee under the option of percentage preparations, otherwise capable opt to make contrary mortgage on the types of a credit line.

It might not be an user-friendly alternative, nonetheless it makes a primary difference between the potential benefit in your home equity when comparing to a property collateral line regarding credit.

Opposite Mortgage against Family Equity Financing Examples

Scenario step one. Jack requires house security line of credit within ages 70. He has got an excellent $3 hundred,one hundred thousand household no present financial.

- Jack can get doing $240,000 amount borrowed (to 80% loan-to-value)

- Jack chooses to obtain $100,100000 out-of their readily available line

- Rate of interest: Perfect + dos.00% amortized over 25 years, otherwise around 5.50%

- Mandatory monthly payment will be $458/attention just otherwise $614/completely amortized

- Rate can change month-to-month

- Settlement costs: $0.00

Circumstance dos: Jack requires a reverse mortgage once the a line of credit on ages 70. He’s got an effective $300,100000 domestic and no established mortgage.

They can decide to pay-off the eye throughout the years, and come up with monthly installments toward you to definitely focus, or simply just postponed the eye due to pay back from the an afterwards date.

- Closing costs: $0.00

- Jack will get doing $172,one hundred thousand loan amount (around 57% loan-to-value)

- Jack decides to obtain $a hundred,one hundred thousand of his offered line

Opposite Mortgages Offer another Personal line of credit Development Ability

Despite to be able to acquire more substantial matter under the household collateral credit line, he may in fact be better regarding about reverse mortgage range out-of credit circumstances for a few reasons.

Earliest, Jack is actually using the credit line progress element you to definitely Domestic Security Conversion process Mortgages ( HECM ) give.

In the event that a reverse mortgage credit line are remaining unaltered, this new unaltered section will in fact build over time , enabling new borrower to view more home guarantee throughout the enough time work at.

This can be a better alternative, specifically for consumers who happen to be younger, only appointment brand new being qualified age of 62. In reality, of many economic planners today are informing the usage of a contrary financial credit line in this way.

Reverse mortgage loans also have the brand new laws and regulations and an economic evaluation to help you help guarantee borrowers will meet the loan conditions. Studies have shown you to retired people who use an opposing financial line of borrowing significantly less than so it personal line of credit options are less inclined to focus on of money in advancing years than those that do maybe not.

Brand new personal line of credit, remaining since the an excellent wet time fund, or simply as the several other bucket of cash to draw off and replenish, is a proven method which is putting on notice inside 2016.

Informal Official certification

In opposite financial, there isn’t any necessary month-to-month repayment, in place of the house equity line of credit that needs constant installment.

The reverse mortgage including can offer lightweight official certification , particularly if the debtor doesn’t have current home loan possesses a beneficial good credit history.

The borrowed funds amount supplied by an opposing home loan line of credit may also be right to have more mature consumers, who would like to provide particular most income, but may not ready to borrow (and you can pay back) a huge sum once the made available of the an effective HELOC option.

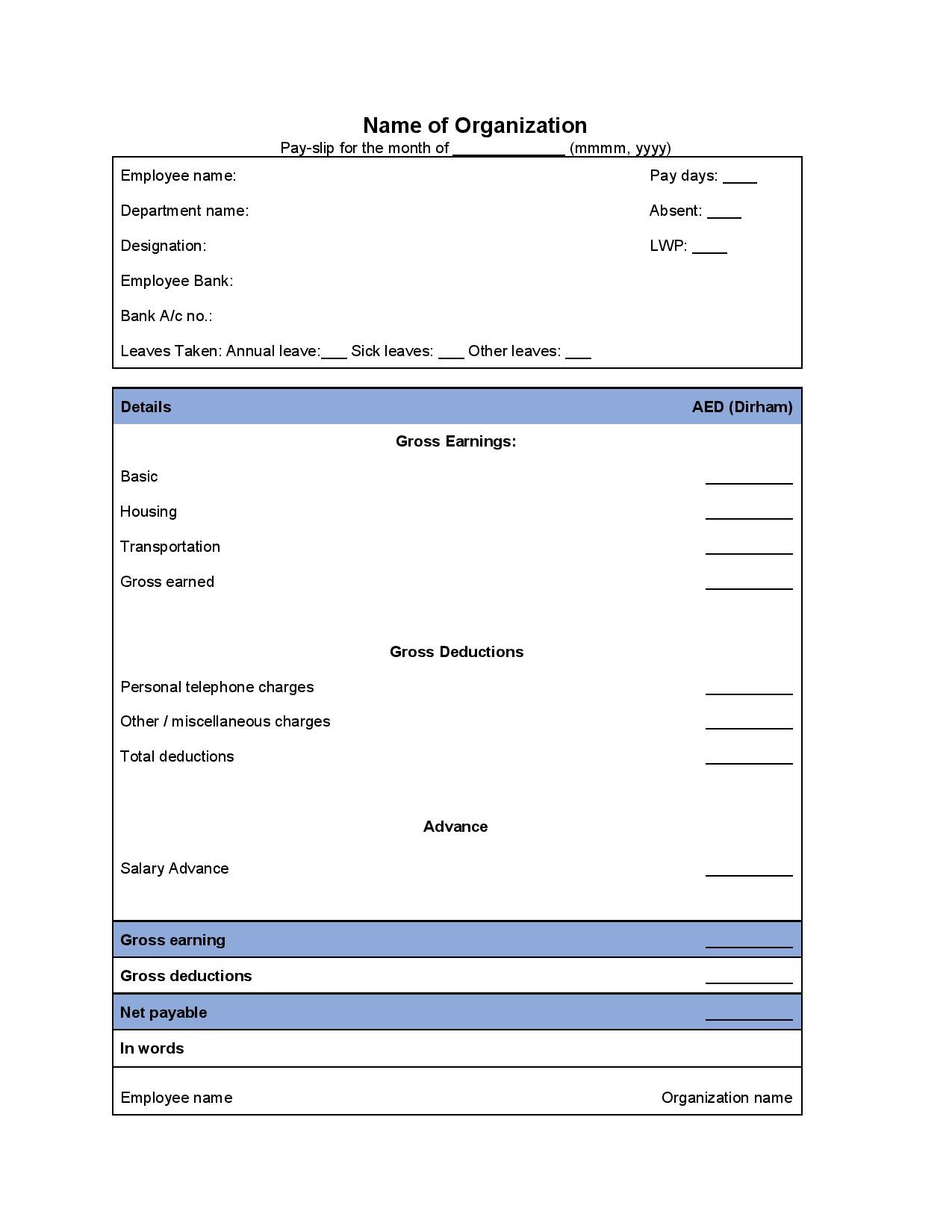

HELOC vs Opposite Home loan Equipment Review

*HELOC money generally enable lenders so you can frost otherwise remove a cards line when your property value your house refuses notably. You need to be prepared to make this balloon percentage from the refinancing by getting that loan out-of some other lender, otherwise from the different function. While incapable of make balloon payment, you might get rid of your house. Source:

**All credit line applications could be suspended for people who fail to maintain taxes and you will insurance coverage, or get-off your home as your no. 1 quarters. For individuals who enter bankruptcy proceeding, courts doesn’t allow you to incur the fresh new personal debt while in BK process and this your personal line of credit during this period is also suspended.