“Undeposited funds” is one of the accounts displayed in your chart of accounts. When you deposit money at the bank, you often deposit multiple payments from different sources at once. The bank usually records everything as a single record with one total. If you enter the same payments as separate records in QuickBooks, they may not match how your bank records the deposit.

About cookies Manage cookies

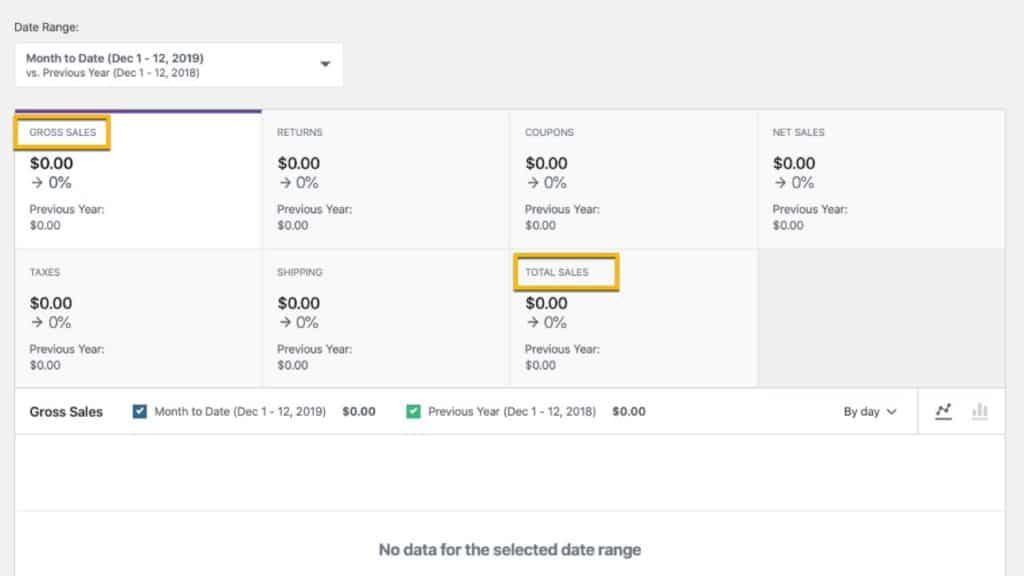

Taking the time to review the list of deposits and verifying the details such as the date, amount, and source can prevent any mistakes. It’s important to remember that once a deposit is removed, it cannot be undone without creating a new deposit entry with all the correct information. Once the user has logged into QuickBooks Desktop, they can navigate to the Banking tab and select Make Deposits. Here, they will find the deposit window, where they can manage and review the deposits before proceeding with the deletion process.

What Is QuickBooks Desktop?

- Each entry might have a checkbox that selects the transactions of the deposits you’re sure you want to delete.

- It is worth noting that QuickBooks categorizes deposits differently based on the type of payment.

- This systematic approach simplifies the reconciliation of bank statements and aids in maintaining the accuracy of financial records.

- Remember that voiding a deposit should be done with caution as it will impact the financial records.

- And I keep getting a message that I cannot delete a payment until I delete the deposit.

Ensuring precision in this process is essential to maintain the integrity of your financial data. Always double-check your choice before confirming the deletion to maintain accurate records. A deposit in QuickBooks refers to the process of adding funds into a bank account, typically from a customer payment or other sources of income. It is a crucial step in maintaining accurate financial records within the QuickBooks software.

Confirm the Deletion

Ensure to review and confirm the deletion, as this action cannot be undone. After deleting the payment, remember to save the changes to record the updated deposit in QuickBooks. Once you’re on the Banking Tab, you can easily locate the deposit records by selecting the specific bank account from which you wish to delete the payment. From there, you’ll find a comprehensive overview of all the transactions that have occurred.

Depending on whether I have deposited these payments into a single or grouped transaction, I can click the box next to the transactions and add as many as I need to the deposit. If each payment was deposited as a single transaction, I should deposit them one at a time. Now that all the payments are recorded in QuickBooks, I am ready to make a few bank deposits.

It’s important to review and confirm the selection before finalizing the deletion process to ensure accurate management of the user’s financial data. Deleting deposits in QuickBooks Online is a crucial task that requires careful attention to detail to ensure the accuracy of your financial records. Whether correcting errors, updating records, or resolving discrepancies, following the step-by-step guide can help you manage this process efficiently.

There is no “Delete Deposit” in the tool bar “Edit” drop down list. And I keep getting a message that I cannot delete a payment until I delete the deposit. There is not an option to delete deposit under the edit in my tool bar. In case if any error arise while deleting the deposit then you need to call the QuickBooks professionals in order to have their help. They will help you and assist you to resolve that error which you are facing while deleting the transaction or payment from the QuickBooks.

Prior to deleting any deposit, it is advisable to review and verify the accuracy of the transaction details to avoid any inadvertent erasures. Once the ‘Delete Deposit’ option is selected, the system will promptly remove the deposit, streamlining the financial management process. Before we delve into the process of deleting a deposit in allowance for doubtful accounts QuickBooks, it is essential to have a clear understanding of what deposits are in the context of this accounting software. In QuickBooks, deposits are recorded as transactions that represent funds received by your business. These funds can come from various sources, such as customer payments, bank transfers, or credit card settlements.

In QuickBooks, a deposit records money received into your business’s bank account. These deposits can come from various sources, such as customer payments, loan proceeds, or investment income. Recording deposits in QuickBooks is essential for tracking your cash flow and ensuring accurate financial reporting. When you receive a deposit, you can enter it into QuickBooks, assign it to the correct account, and mark it as “deposited” so it reflects in your bank account balance.

This confirmation process is crucial to maintain accurate financial records. Once confirmed, the next step is to reverse the entry related to the deleted deposit, ensuring that it no project cost control longer impacts the financial statements. In some instances, a deposit may have been recorded incorrectly, and deleting it becomes necessary to ensure accurate financial records.

QuickBooks offers its customers two different, yet quite comparable products – QuickBooks for desktop and QuickBooks Online (QBO). The most obvious difference is that the desktop version works well for large company systems where the need for mobility is not paramount. Meanwhile, the online version is quite versatile but focused on small companies that need mobility. In this article, we’ll tell you all you need to know about deleting a deposit and the difference between using QuickBooks Desktop and QuickBooks Online for your business. Feel welcome to leave a comment below if you need more help in handling your other transactions.

While there aren’t features in QuickBooks to directly restore the deleted deposit, you can still find a record of the deposit in the audit log. You can then copy the details of your deleted deposit international journal of computerized dentistry to recreate the deposit. Mistakes happen, and you may have added a payment accidentally or recorded the deposit twice. All payments on the deposit go back to the Undeposited Funds account.

You can manually add funds to deposits in the bottom section of the Bank Deposit screen. You need to enter these manually (assets, liabilities and equity to accounts) since these don’t come from sales forms. You have a search bar or filters such as transaction type, Data Type, and Date Range.